How Presidential Elections Impact the Housing Market in Houston, Katy, and Fulshear

As we approach another presidential election, many homeowners and prospective buyers in Houston, Katy, and Fulshear are wondering: “How will the election impact the housing market?” While the answer isn’t always straightforward, looking at historical data gives us some valuable insights into how the market has behaved in previous election years.

Let’s dive into what you need to know about:

- Whether home prices typically go up or down during an election year: Discover whether your home equity is safe based on past trends in the Houston area.

- What happens with mortgage rates during an election year: Learn how rates have typically behaved and what that means for your buying power.

- Do home sales slow down or pick up? Find out if now is a good time to buy or sell, or if you should wait for post-election market conditions.

- What this means for you? Insider insights for Katy, Fulshear, and Houston area homeowners, sellers, and buyers.

Read on for the detailed breakdown and historical statistics or click the video below for your one-minute explanation. And as always, feel free to reach out at 832.594.1265 or [email protected] to discuss your unique situation!

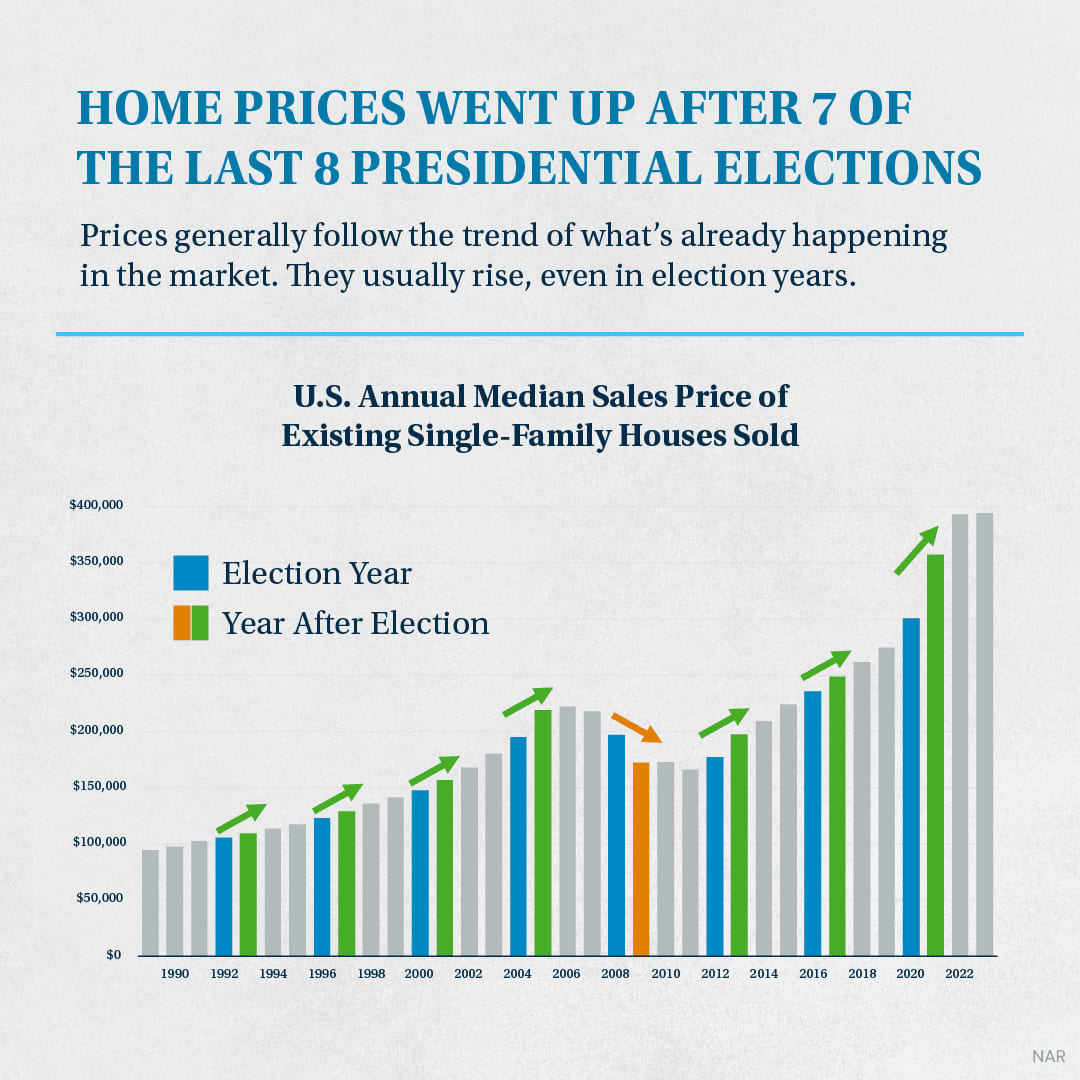

Home Prices and Presidential Elections

Historically, home prices have shown a remarkable resilience during election years. In fact, according to data from the National Association of Realtors (NAR), home prices increased after 7 out of the last 8 presidential elections. Any guesses on the only year that prices went down? 2008! And that was during a housing recession. Not your typical year.

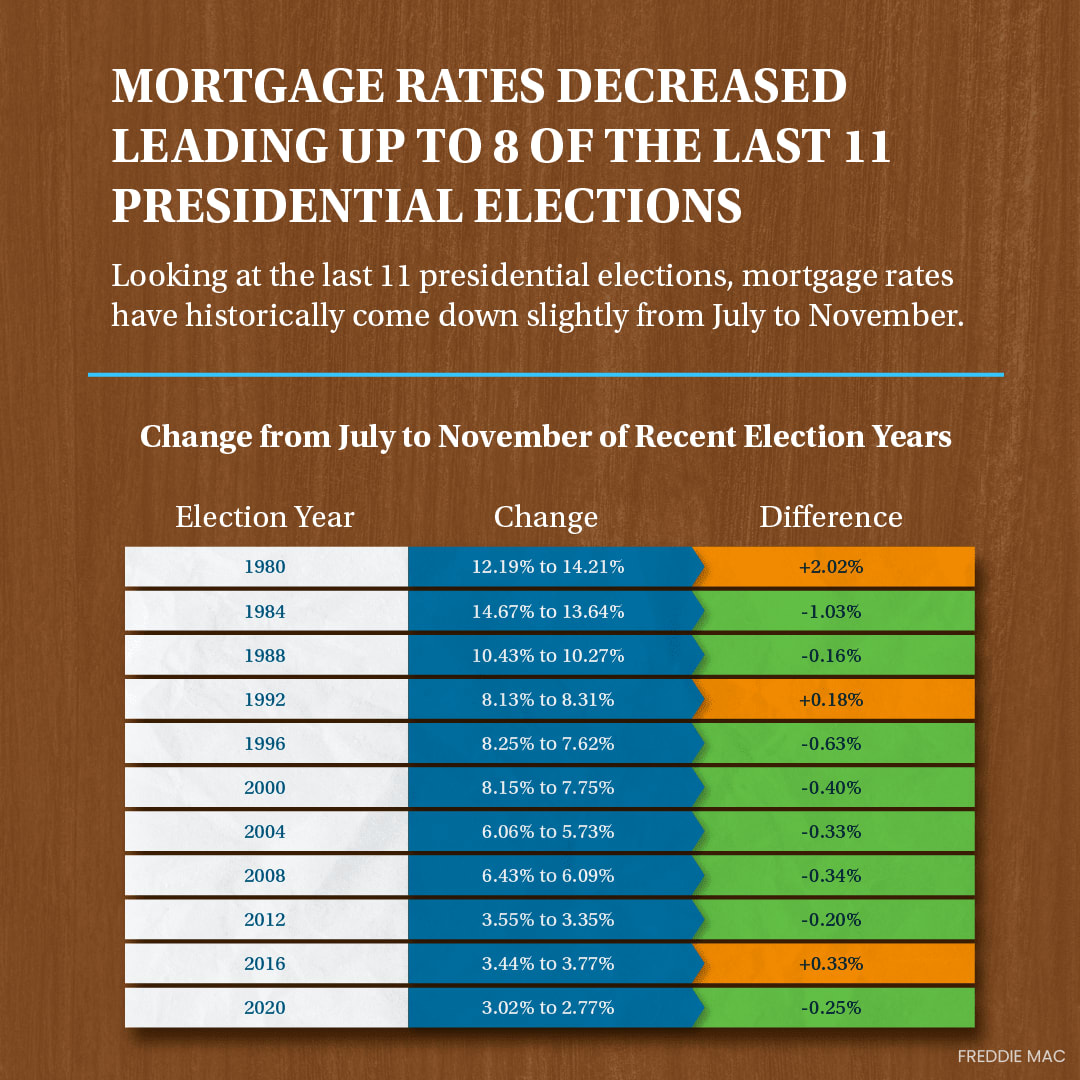

Mortgage Rates During Election Years

Home Sales Tend to Bounce Back

What Does This Mean for You?

If You’re a Buyer: Keep an eye on mortgage rates. With rates trending lower leading up to the election, you might have a chance to lock in a better deal, giving you more buying power and options in the market.

The Bottom Line

While every election year is different, the historical data provides some reassuring trends for homeowners and potential buyers. With home prices generally rising, mortgage rates potentially dipping, and sales bouncing back after elections, there’s every reason to stay optimistic about the housing market in Houston, Katy, and Fulshear.

Curious about how the Katy, Fulshear, and Houston real estate market is currently performing? Head to the Summer 2024 Summer Market Recap for the inside scoop on the record-breaking home prices and a 30% increase in the number of available homes.

Ready to explore your options? Let’s chat about how you can take advantage of the current market conditions to achieve your real estate goals. Reach out today for a personalized consultation.