Find It Fast

- Texas Proposition 4: Your Guide to Understanding the New Property Tax Relief

- A Deeper Dive into Proposition 4: What Houston area Homeowners Need to Know

- Beyond the Homeowner: A Wider Scope

- Your Next Steps

- The Takeaway

Texas Proposition 4: Your Guide to Understanding the New Property Tax Relief

Great news, Houston homeowners! Texas voters have spoken, and the result is a major property tax win for Houston area homeowners. Proposition 4, a significant property tax relief package, has officially been approved!

So, what does that mean for your wallet and when can you expect to see the property tax savings?? Let's dive into the details.

A Deeper Dive into Proposition 4: What Houston area Homeowners Need to Know

What is Proposition 4?

Proposition 4 is a $12.7 billion property tax relief package. It's designed to provide substantial relief by:

- Increasing the Homestead Exemption: The exemption on your primary residence for school property taxes jumps from $40,000 to $100,000 (and $110,000 for those aged 65 and older).

- Tax Compression: An additional mechanism that provides more funding to school districts, enabling them to reduce property taxes.

What is tax rate compression?

This part involves reducing school tax rates with the state compensating for the revenue loss. Each school district is required to reduce its tax rate by 10.7 cents per $100 of taxable value.

When Will You See the Changes?

You are not going to have to wait long to find out how much of a cut you will see! The 2023 property tax bills are going out now!

When will you know exactly how much you are going to save?

Your property tax bill will include the previous amount due with your $40,000 Homestead Exemption AND your new property tax bill amount with the $100,000 exemption applied.

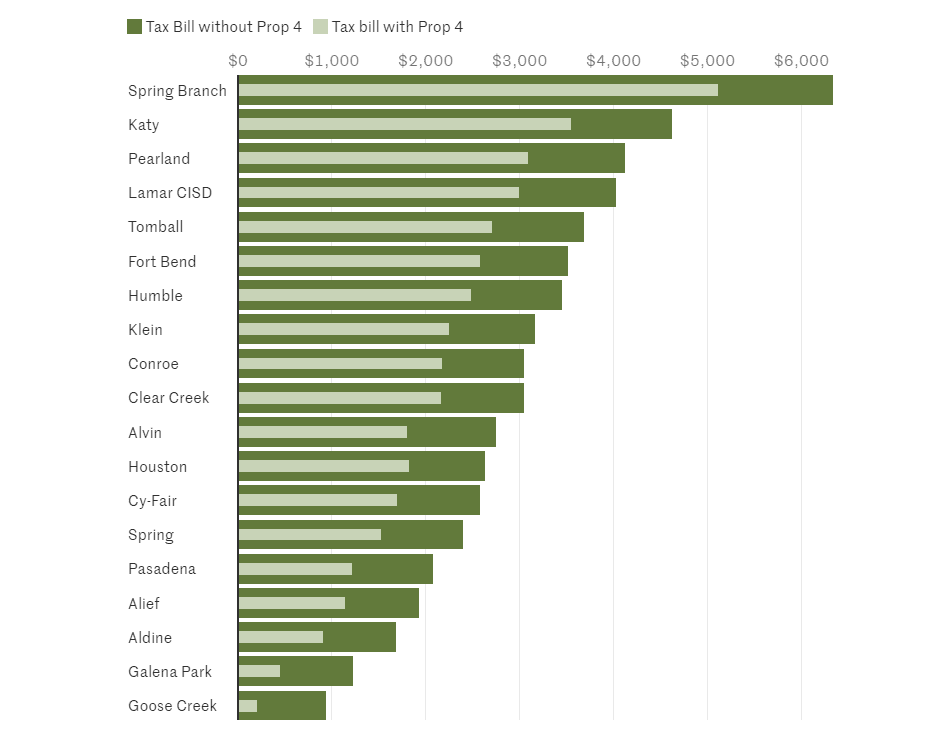

The typical Houston-area homeowner will save close to a $1,000 per year on their school property tax bill. Here is a look at the school tax amounts for the average home in the largest Houston-area school districts.

Beyond the Homeowner: A Wider Scope

Proposition 4 isn't just about homeowners. It extends its benefits by:

- Temporarily capping the annual appraisal growth for small businesses and non-homestead properties, like second homes and rentals.

- Small Business Relief: Small businesses earning up to $2.47 million annually are now exempt from franchise taxes, benefiting around 67,000 businesses.

- Creating new elected positions on appraisal boards in larger counties.

Your Next Steps

- Apply for Homestead Exemption: If you haven't already, apply for the homestead exemption NOW!!

- Be on the lookout for your 2023 tax bill!

The Takeaway

I'm excited to share how these changes can positively impact your financial planning and real estate decisions. If you have any questions or need more personalized advice, feel free to reach out.

Remember, staying informed and understanding these changes is key to making the most of your real estate investments in Houston. Let's navigate this together for your best financial future!

Share: