Find It Fast

J

ust when you thought you were done dealing with your taxes for the year, it is time to consider protesting your property tax valuation. Every year your local appraisal district assesses your home’s value for taxation purposes. The value is based what the property could sell for ON January 1st of that year. Condition of the home, your neighborhood’s home values and accuracy of your home’s features all play a part in coming up with that value. Once you receive your Notice of Appraised Value, look over the numbers carefully. If your property is not described correctly or if the value looks out of whack, you should protest it. Also make sure your Residential Homestead is listed under exemptions! If it is not, you have until April 30th to file.

Texans have the right to uniform and equal taxes. However, the system is set up that the property owner must appeal to ensure that is the case. The deadline to contest your property taxes is May 15th or 30 days from when your notice was mailed (whichever is later).

**DISCLAIMER! I am not a property tax expert. I strongly believe in adding value beyond the transaction. I believe providing quality resources to help my clients enjoy their home, to ensure they maximize homeowner benefits and help make their house a home while saving money in the process. Make sure you do your research, carefully review the information provided in the “resources” section below and/or contact a tax professional. If you would like me to run comparables on your home, please email me at [email protected] or call me at (832) 594-1265.

Property Tax Bill Sticker Shock in Harris & Fort Bend County:

You are not alone if you are still reeling from the sticker shock of your recent year’s Property Appraisal Notice. A few years ago, the majority of Houstonians' started to notice that the era of the appraisal districts underestimating your home value was rapidly changing. In 2016 we started to see the local real estate market drastically come to a halt, however the appraisal districts property values did not follow suit. In the last couple years Harris County Appraisal District (HCAD) and Fort Bend County Appraisal District (FBCAD) came under hot water for not lowering the home evaluations to correlate with the local real estate market.

I’m not a property tax protest expert, but I can send you comparables to use and outline the steps to protest your property taxes. There are also a slew of companies in the area that will protest your taxes for you (with a percentage taken out for their fee). Whether you decide to do it yourself or hire a company to do it for you, it is important to understand the process so you can make an informed decision.

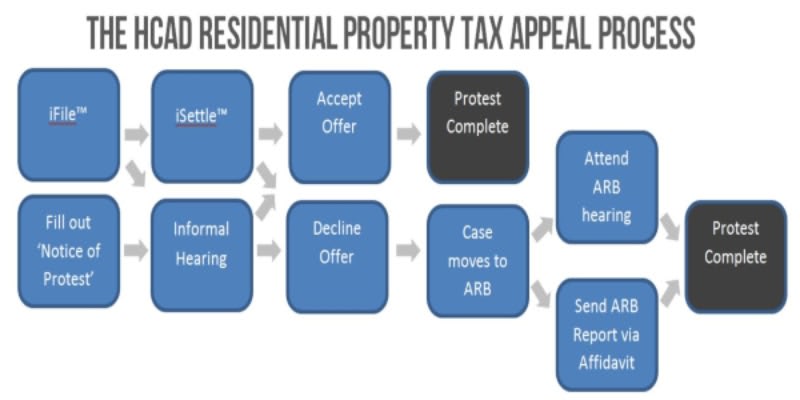

In this Blog post, I am going to focus on protesting your taxes on your own using the appraisal districts online system (informal hearing) and making your case in front of the Appraisal Review Board (ARB) in Harris and Fort Bend County.

Steps to Protesting Your Property Taxes in Harris & Fort Bend County:

**FBCAD’s Tax Appeals Process is nearly identical to what is shown in this chart.

Submit a written Notice of Protest form by May 15th. Detailed instructions of how to file online can be found in the resources section below. You will need to identify the property being appealed and the basis for your appeal. Pay close attention to the boxes you check off stating the reason for your protest. Your choices will affect the kind of evidence you can submit down the road. If you are appealing because the value is too high, I strongly recommend appealing on both “Assessed value is over market value” and “Value is unequal compared with other properties.” Checking both boxes will allow you to present the widest types of evidence. If the square

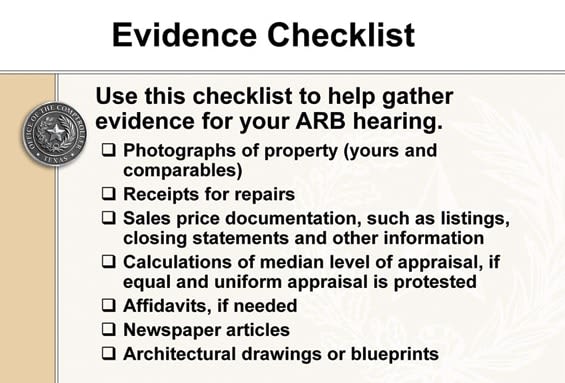

You are required to upload documents supporting why you feel that your appraisal value it too high. Documentation can include (but not limited to) a recent closing statement, an appraisal, pricing of recently sold homes that directly compare to yours (this is where I can help!), pictures of repairs needed, quotes on company letter head of the cost of repairs needed and/or a floor plan of your home.

“Property Description is Incorrect”

Check the property improvement (building data) details for accuracy. Does it have the correct square footage, accurate lot size and number of beds, baths and garage spaces? If the appraisal district shows that you have MORE of any these features, file a protest to have them correct it as that could result in a reduction. Hence the word MORE!

“Assessed value is over market value” & “Value is unequal compared with other properties"

One popular method is to ask me, Your Realtor, to email you comparable sales numbers to refute the tax value. You can also find someone in your neighborhood with the exact same floor plan and check their numbers on the appraisal district’s website. If their values are lower, use their pictures and tax records (available on the appraisal districts website) in your supporting documents. If your home has significant problems that affect its value, show pictures and get estimates to show why your home’s value should be lower. The condition on January 1st is key as you look at factors that affect the value. Any damage after this date, won’t affect the taxable value of your home this year.

The appraisal district will review your evidence along with other market information provided by an Appraiser. They will either make an offer to reduce your assessed value or request that you present your evidence at an ARB hearing. As soon as HCAD or FBCAD notifies you of their decision, you will be able to log onto your online account to access the information and market data they used when considering your appeal. That information will play an important role when deciding whether to accept their offer and when preparing your case for the ARB hearing!

If you decline the appraisal district’s offer after the informal process, your next step is to present your evidence in front of the ARB. It is important that you know exactly how to prepare for your ARB hearing. I recommend that you carefully review The Homeowner’s Guide to Presenting Your Case at an ARB Hearing.It outlines the process in detail including what to expect (the format of the hearing), exactly how to prepare your evidence, approaches to take, burden of proof and what to do if you are still not satisfied after your ARB hearing. You have a right to obtain copies of all information that the appraisal district used to appraise your property. If you aren’t able to access it online, make sure that you request this information, study it and find comps to refute it. Under the law, the appraisal district has the burden of establishing the value of your property. If they fail “to prove your home’s value by a preponderance of the evidence, the ARB must rule in your favor.”

DO: Come with a specific value you believe your home is worth and the documentation to support that figure.

DO: Request, in advance, the appraisal district’s documentation they used to assess your tax value. Review it in detail to determine if there are differences that might make those properties a poor comparison to yours. I.e. property size, upgrades, number of beds/baths, proximity to a busy road, etc…

DON’T: Be emotional. Craft a clear convincing argument and state the facts. A long rambling presentation filled with generalizations is not going to get it done.

DON’T: Be rude. Your frustration is with the appraisal district, not the review board. “You catch more bees with honey than vinegar!"

DO: COME PREPARED! Know what documents you need to bring, how many copies of each and the format of the hearing before you go.

Important Information About the Protest Process

Notice of Protest – Instructions for Filing Online:

Fort Bend County Appraisal District

Harris County Appraisal District

How to Present Your Case at a ARB Hearing: A Homeowner’s Guide

The Texas Comptroller’s Website – Tax Information

Property Tax Payer Remedies

Frequently Asked Questions