The Equity Boom: How Houston, Katy, and Fulshear Homeowners Are Cashing In Big

Home values in Houston, Katy, and Fulshear have skyrocketed across all price points and neighborhoods—something we’ve never seen before in my 15+ years as a real estate expert. In the JUST last 5 years, home values have surged by a mind-blowing 66.7% in Katy's 77494 zip code! If you own a home, your equity has likely surged far more than you realize. This isn’t just a trend—it’s a once-in-a-lifetime opportunity to capitalize on the wealth your home has built for you.

Did you know that the recent equity gains are the largest rise ever recorded by the federal Survey of Consumer Finances?

As home prices continue to rise, knowing the value of your home is essential to making informed decisions. Let’s take a look at:

- How much equity Houston, Katy, and Fulshear homeowners have gained in the last 5 years.

- What home equity is and its financial power.

- Smart ways local homeowners are leveraging their equity gains.

- How to find out how much equity that you’ve gained.

Whether you’re thinking about moving or staying put, now is the time to discover exactly how much equity you’ve gained and how you can put it to work for your future. CLICK HERE to request your custom equity insights report or reach out to me directly at 832.594.1265 or [email protected].

Read on for what you need to know or click the video below for your one-minute equity insights.

Massive Home Equity Gains in Houston, Katy, and Fulshear: The Numbers Don’t Lie

Home prices in Houston, Katy, and Fulshear have surged across the board. In fact, Houston just set TWO ALL-TIME HIGH pricing records this summer! One in May 2024, and then again when July 2024 broke that record!

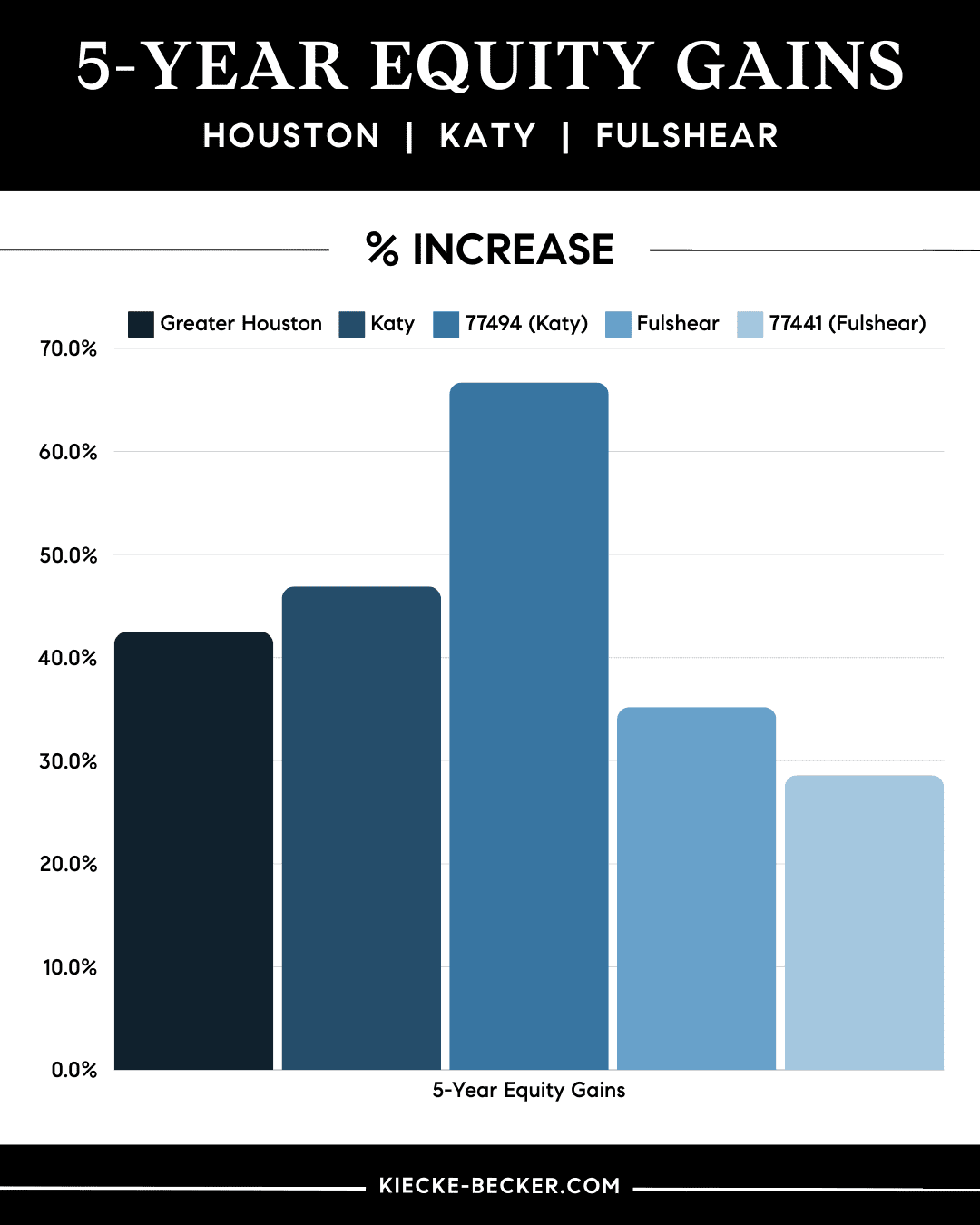

Here is a look at the average equity percentage gains for single-family homes in Greater Houston, Katy, and Fulshear:

Take a look at Katy’s 77494 zip code! Home values shot up by a mind-blowing 66.7%! These increases translate into tens (or even hundreds) of thousands of dollars in equity that many homeowners may not even be aware of.

What is home equity?

Home equity is the portion of your home that you actually own outright. It’s the difference between your home's value and the amount you still owe on your mortgage. As you pay off your mortgage OR home prices rise, your home gains equity.

Home equity is the primary means of wealth creation in the United States. For most homeowners, their home’s equity is their largest financial asset, beating out stocks, bonds, and other common investment sources.

Why Understanding Your Equity Matters

Home equity is one of the most powerful tools homeowners have. But without knowing how much equity you’ve built, it’s hard to leverage it to your advantage.

I recently worked with a homeowner in Cinco Ranch who discovered he had gained a massive $425,000 in equity since purchasing his home in 2018. With this knowledge, we sold his current home, and he used his massive equity gains to upgrade to a larger home for his growing family. His equity covered the down payment and gave him enough left over to buy down the interest rate on his next mortgage.

That’s why understanding your home’s current value is so important—it can be the key to unlocking your next move, improving your current home, or simply knowing where you stand financially.

How Homeowners Are Using Their Equity: Key Opportunities

Here are some of the top ways local Houston, Katy, and Fulshear area homeowners are taking advantage of their historical equity gains:

Moving Up to a Home That Better Suits Your Needs

Many families find their needs change over time—whether it’s needing more space, a home office, or moving closer to better schools. Using the equity you’ve gained as a down payment on your next home not only allows you to upgrade, but it can also help you buy down your interest rate, making your new mortgage more affordable despite today’s higher rates. This is an ideal solution for those currently on the fence due to their low interest rate.

Reinvesting in Your Current Home

If you love where you live but want to boost your home’s value, using your equity for renovations can be a smart move. Upgrades like a kitchen remodel, new flooring, or an outdoor living space can increase your home’s value while also enhancing your lifestyle.

Funding Major Life Goals

Home equity can also be used for larger expenses like funding your children’s education or making strategic investments that build wealth.

The Interest Rate Elephant in the Room

Let’s face it—interest rates are higher than they’ve been in years, and that can feel like a roadblock for anyone thinking about making a move. The thought of trading in your low-rate mortgage for a higher one might be enough to keep you stuck in a home that no longer fits your needs. But staying put could mean missing out on the incredible equity you’ve gained—and that’s where the real opportunity lies.

In fact, your equity is the key to sidestepping those higher rates.

Here’s the good news—your equity gives you the power to sidestep today’s interest rates. If you’ve built enough, you could use that equity to become an all-cash buyer, avoiding the need for a mortgage entirely. No loan means no interest rates to worry about, and in a competitive market, paying cash could help you close faster and secure your dream home.

If going all-cash isn’t an option, you can still use your equity for a larger down payment, reducing the amount you need to borrow. That larger down payment could get you a better interest rate, as lenders often reward buyers who put more money down. The Mortgage Reports explains:

“Borrowers who put down more money typically receive better interest rates from lenders because a larger down payment lowers the lender’s risk.”

Either way, leveraging your equity means you can take control, beat the higher rates, and maximize your buying power.

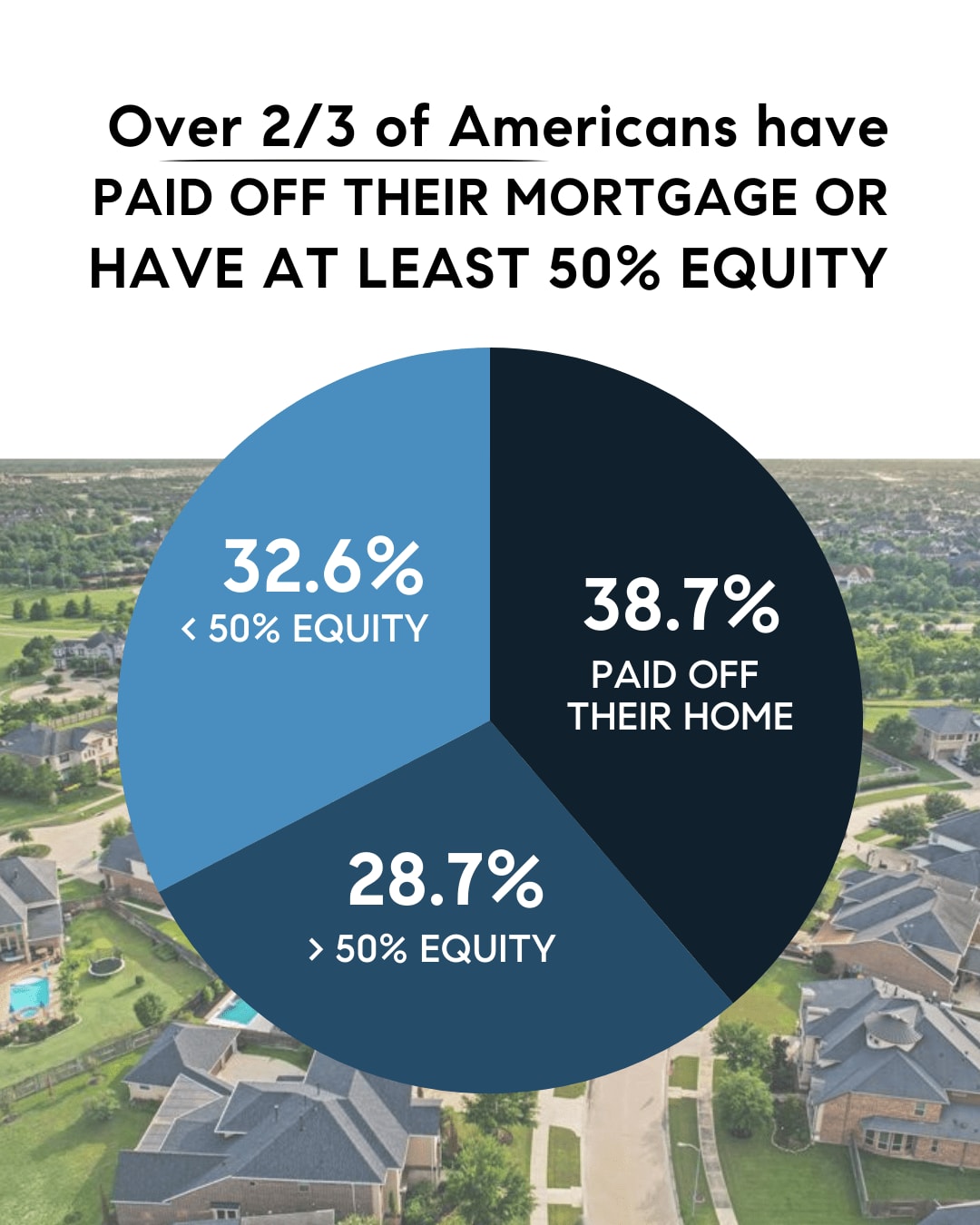

Over Two-Thirds of Americans Are Equity Rich

It’s not just Houston and Katy homeowners benefiting from surging home values. Across the country, more than two-thirds of homeowners have either paid off their mortgage or have at least 50% equity. This means the vast majority of homeowners are in a prime position to use their equity to their advantage.

How to Find Out How Much Equity You’ve Gained

Every homeowner’s situation is unique, and the best way to know how much equity you’ve built is to reach out to a Realtor for an equity insights report. I offer custom equity reviews to my past clients and local homeowners so they can make informed decisions and maximize their homeowner benefits. Whether you’re considering a move or simply want to know the financial power your home holds, contact me at 832.594.1265 or [email protected] to request your free equity review and personalized advice tailored to your real estate goals!